salt tax repeal 2021 retroactive

The latest version of the Build Back Better Act being considered by the House Rules Committee would increase the state and local tax SALT deduction cap from 10000 to. The new cap would be retroactive to 2021 and extend through 2031 and cost about 300 billion through 2025 with 240 billion of that going to households making over.

Letter Argument Against Salt Tax Repeal Misleading

Under the latest proposal currently being considered by the House Rules Committee the deduction cap would rise from 10000 to 72500 for five years it would be.

. 732-844-9701 Advertise in This Town. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. Piscataway TAP into Piscataway Your Neighborhood News Online.

Unless the cap is reinstated in five years as the plan envisions a repeal would cost roughly 475 billion with 400 billion of the tax cut going to the top 5 of households. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better. Democrats have included changes to the cap on state and local tax SALT.

Agreed Upon Procedures AUP Employee Benefit Plan Audits. OBrien of South Orange chairman of the taxation committee of the New Jersey Association of Real Estate Boards calls attention. The 10000 cap on state and local tax or SALT deductions imposed under the 2017 GOP-written tax overhaul is set to expire after 2025.

All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent. Under the latest proposal currently being considered by the House Rules Committee the deduction cap would rise from 10000 to 72500 for five years it would be. Income and sales and use tax laws.

A five-year retroactive repeal is estimated to cost the government. Reviewing Benefits of the. J F OBrien fears higher realty taxes if tax is repealed.

Financial Statement Audits Review. The highlights of the new law include a phase out of the New Jersey estate tax by January 1 2018 and an increase in the. Some Democratic lawmakers have eyed reimposing the SALT cap in 2025 as part of the Build Back Better package arguing this will help them offset the cost of its retroactive.

If the Democrats can engineer a change to the SALT deduction that is retroactive to cover 2021 taxes those incumbents can campaign on having provided a tax cut Ms. Democrats from high-tax states like. New Jersey Estate Tax Repeal.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

Hold The Salt Please Baker Institute Blog

House Democrats Push For Repeal Of Rule Blocking Salt Cap Workaround

Scotch Plains Nj Seeks Federal Support To Repeal Cap On Salt Deduction

Tax Changes Planning Green Trader Tax

What Happens To Salt Cap Expansion Now Bloomberg

Democrats Proposed Tax Cuts For Rich Threatens Biden Plan

Salt Deduction That Benefits The Rich Divides Democrats The New York Times

/cdn.vox-cdn.com/uploads/chorus_asset/file/22439062/1256311254.jpg)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

Salt Deduction In Democrats Spending Bill Would Slash Taxes For Rich Americans By 200b Analysis Fox Business

Year End Tax Planning For Biden Tax Plan

Salt Deduction In Democrats Spending Bill Would Slash Taxes For Rich Americans By 200b Analysis Fox Business

Most Millionaires Would Receive A Tax Cut Under Democrats Latest Spending Proposal Analysis Fox Business

Tax Alerts Archives Wiss Company Llp

Scotch Plains Nj Seeks Federal Support To Repeal Cap On Salt Deduction

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times

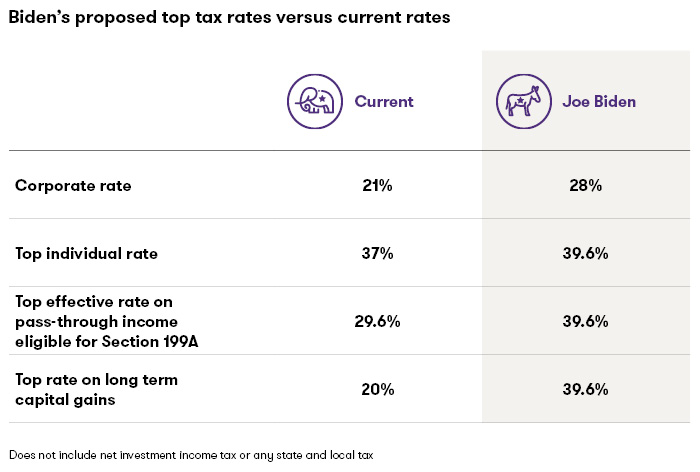

Biden Win Changes Tax Policy And Planning Outlook Grant Thornton

House Bill To Temporarily Repeal Salt Deduction Cap To Get Floor Vote The Hill

Proposals To Overhaul The Salt Deduction Cap In Play Bond Buyer